How to Recover a Dishonored Check From a Business Partner

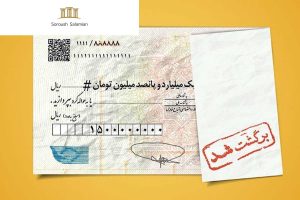

A check is one of the most common payment instruments used in commercial relationships between business partners. In many partnership arrangements, checks are used for account settlement, as security, or to cover financial obligations. In practice, however, one of the most frequent disputes between commercial partners arises when a check is issued without sufficient funds and is returned unpaid. When a check cannot be cashed, the holder may take legal action to recover a dishonored check from the business partner who issued it.

Under Iranian trade-related rules and the law governing the issuance of checks, a check is generally treated as an instrument of immediate payment. Unlike a promissory note or bill of exchange, it typically does not require separate proof of the underlying debt for basic recovery purposes. After the check is returned unpaid, the holder may pursue recovery within specific statutory time limits. In business partnerships, a dishonored check can seriously damage trust, trigger conflict, and, in some situations, lead to termination of the commercial relationship.

For this reason, a clear understanding of how checks operate, how to use them lawfully, and how to pursue recovery is essential for anyone who exchanges checks in a commercial setting. This knowledge helps ensure that, if a dispute arises, the holder can follow the proper legal route and enforce their rights through lawful mechanisms.

When is a partner’s check considered dishonored?

To begin the process of recovering a dishonored check from a business partner, the legal conditions for dishonor must be established. A check is treated as dishonored when the holder presents it to the bank on the date stated on the check and the bank refuses payment for reasons such as insufficient funds, a blocked account, or a mismatched signature.

In that situation, the bank must issue a certificate of non-payment. This certificate is a formal document confirming that the check was not payable and serves as the basis for both civil and, where available, criminal follow-up against the issuer. Without obtaining this certificate, effective civil or criminal action is generally not available. The date written on the check is also critical. If the check is postdated, the holder cannot present it for payment before its stated due date. Accordingly, recovery steps can begin only after the check is presented at maturity and the certificate of non-payment is obtained.

Civil recovery steps for a dishonored check from a business partner

After receiving the certificate of non-payment, the holder may pursue recovery through judicial authorities. In general, there are two primary routes: a civil claim and a criminal complaint. The appropriate choice depends on the circumstances of issuance and the time elapsed.

In the civil route, the claimant files a lawsuit seeking payment of the check amount and submits a copy or the original of the check, along with the certificate of non-payment, to the court. This approach is often suitable where significant time has passed, the case does not clearly support a criminal allegation, or the holder prefers a civil remedy.

In the criminal route, if the check was intentionally issued without funds, a criminal complaint may be filed within 6 months of the due date, subject to certain conditions. This route is commonly viewed as more coercive because it may result in summons and, in certain cases, arrest-related measures against the issuer. In both pathways, engaging counsel experienced in recovering dishonored checks from business partners can materially improve strategy, documentation, and the speed of proceedings.

Filing a criminal complaint against a partner for a dishonored check

A criminal complaint can be one of the most effective legal tools for recovering a dishonored check from a business partner, particularly where bad faith is evident. Under Article 10 of the law governing the issuance of checks, if a check is returned unpaid due to insufficient funds, issuance from a blocked account, or fraudulent conduct, the issuer may be subject to criminal prosecution.

To proceed, the holder generally must file the complaint within a maximum of six months from the date the certificate of non payment is issued, at the prosecutor’s office with jurisdiction over the bank branch where the check was presented. Required documents typically include the original check, the certificate of non-payment, and identification documents.

After registration, the matter enters the preliminary investigation stage, and the issuer may be summoned to appear. If authorities determine that the check was deliberately issued without funds, the prosecutor may issue coercive measures, including an arrest order under applicable rules. In many cases, this pressure encourages the issuing partner to settle more quickly.

Civil lawsuit to recover the value of the check

If criminal prosecution is not available for any reason, or if the statutory deadline has passed, the holder may still recover the dishonored check through a civil lawsuit. This option is often preferred by those who want recovery without criminal escalation, or who also intend to claim delay damages.

A civil claim is typically submitted through judicial electronic service offices, attaching the necessary documents such as the original check and the certificate of non-payment. The case is then assigned to a civil court branch. If the court confirms the claim, it may issue a judgment ordering payment of the check amount, delay damages, and litigation costs. Once a judgment is obtained, the holder may proceed to enforcement measures, including seizure of the business partner’s assets.

The role of the Dispute Resolution Council for lower-value checks

If the check amount is below 20 million tomans, the jurisdiction may fall within the Dispute Resolution Council. In such cases, the holder may file a claim for recovery of the dishonored check against the business partner with the council with jurisdiction over the issuer’s place of residence.

After review of the documentation, the council may issue a decision in favor of the holder. That decision can be enforceable and may lead to seizure of accounts or assets. Although the council process can be simpler and faster, it may also involve practical limitations. For that reason, legal guidance is often advisable to ensure the matter is handled effectively.

Security checks and whether they can be recovered

In many commercial relationships, partners issue checks described as security checks to guarantee performance of obligations. Whether such checks can be recovered depends on whether the issuer can prove the instrument’s security nature and whether the underlying obligation has been performed.

If the issuer establishes before the court that the check was provided solely as security and the principal obligation has been fully performed, the holder’s claim may be rejected. However, as a general principle, even a security check may be recoverable unless a legally acceptable defense is proven.

Statutory time limits for pursuing a dishonored check

Meeting statutory deadlines is critical when recovering a dishonored check from a business partner. Missing these deadlines may eliminate certain legal options.

- For criminal complaints: up to six months from issuance of the certificate of non-payment

- For recovery through the registration enforcement route: fifteen days from the date of dishonor

- For a civil lawsuit: up to five years, subject to non-payment of the check amount

If these deadlines are not observed, the remaining available route may be a longer civil process.

Using registration enforcement to recover a dishonored check

Checks issued in Iran may be enforceable instruments. As a result, the holder may pursue recovery through the registration enforcement process without filing a lawsuit in court. To do so, the holder submits the original check and the certificate of non-payment to the relevant registration office and requests issuance of an enforcement order.

This method is often faster and less costly than litigation. If the business partner does not pay within the prescribed period, the registration authority may take enforcement measures, such as seizing assets, freezing accounts, and, in certain cases, imposing travel restrictions, in accordance with applicable rules.

Claiming damages for late payment

If the business partner delays payment of the dishonored check, the holder may seek delay damages in addition to the principal amount. These damages are generally calculated based on official inflation indicators and the duration of the delay. To obtain such damages, the claim should be expressly requested in the civil petition. The court may order payment of delay damages where the delay is established and unjustified. This can significantly increase the deterrent effect of pursuing recovery.

How a dishonored check affects a partner’s commercial credibility

A dishonored check can directly damage an individual’s commercial standing. Under updated check regulations, dishonored checks may be recorded in the Central Bank system and can lead to restrictions such as account limitations, the inability to receive new checkbooks, and other legal consequences, including potential travel-related restrictions, depending on enforcement measures. From a business perspective, a partner with dishonored checks may lose trust and face difficulty continuing commercial relationships. Therefore, recovery of a dishonored check from a business partner is not only a legal step but also an important decision in managing commercial risk.

The role of legal counsel in recovering a dishonored check from a business partner

An experienced lawyer can play a decisive role in the success of a dishonored check recovery matter. From selecting the proper route, civil, criminal, or registration enforcement, to drafting the necessary filings, presenting arguments, and pursuing enforcement, legal strategy and precision are essential.

In many cases, a formal legal notice issued by counsel can prompt payment without the need for lengthy proceedings. Counsel can also help prevent counterclaims and manage unfounded defenses raised by the non-paying partner.

Frequently Asked Questions About Recovering a Dishonored Check From a Business Partner

A check is considered dishonored when the holder presents it to the bank and payment is refused due to reasons such as insufficient funds, a blocked account, or a signature mismatch, and the bank issues a certificate of non payment.

The holder may proceed through three main routes depending on the circumstances: a criminal complaint, a civil lawsuit, or the registration enforcement process.

Commonly cited deadlines include up to six months for a criminal complaint from the date of the certificate of non payment, fifteen days for the registration enforcement route, and up to five years for a civil lawsuit from the date of the check, subject to non payment.

Yes. A security check may be recoverable unless the issuer proves that it was issued solely as security and that the principal obligation has been fully performed.

Counsel can help select the most effective legal route, prepare filings, represent the holder during proceedings, and pursue enforcement. In many cases, a formal legal notice can also prompt quicker payment. What is a dishonored check and when does it occur?

How can a dishonored check from a business partner be pursued?

What are the legal deadlines for criminal and civil action?

Can a security check also be recovered?

What is the role of a lawyer in recovering a dishonored check from a business partner?